Our research model

Although most of our work involves companies listed on the JSE, our research model and evaluation processes can just as easily be applied to private companies and state-owned corporations.

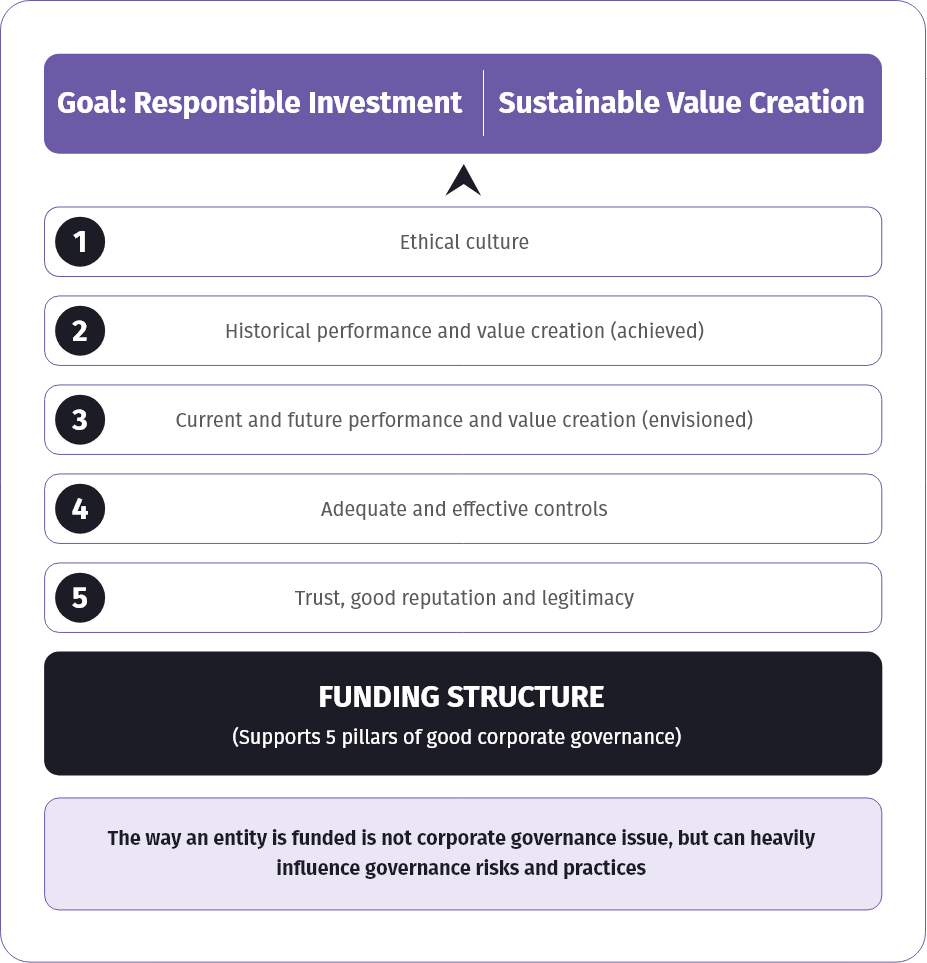

Graphically, our research model resembles a house: the funding structure is the foundation on which five pillars of sustainability are built. The pillars support the roof, ie the end goal of responsible investment and sustainable value-creation.

Under the guidance of Dominique Laroque and Syd Vianello, our team researched legislation, practices, industry codes and best-practice guidelines in all industries and geographies across the globe to develop a robust scoring methodology for evaluating a company’s sustainability strength.

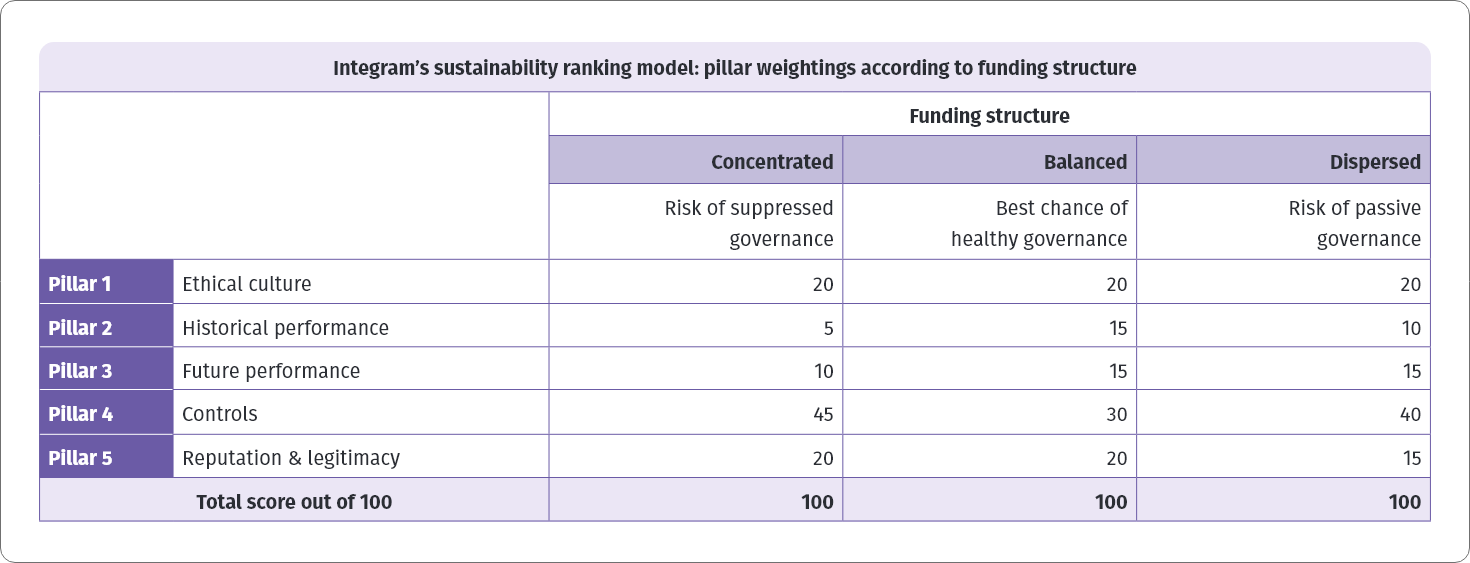

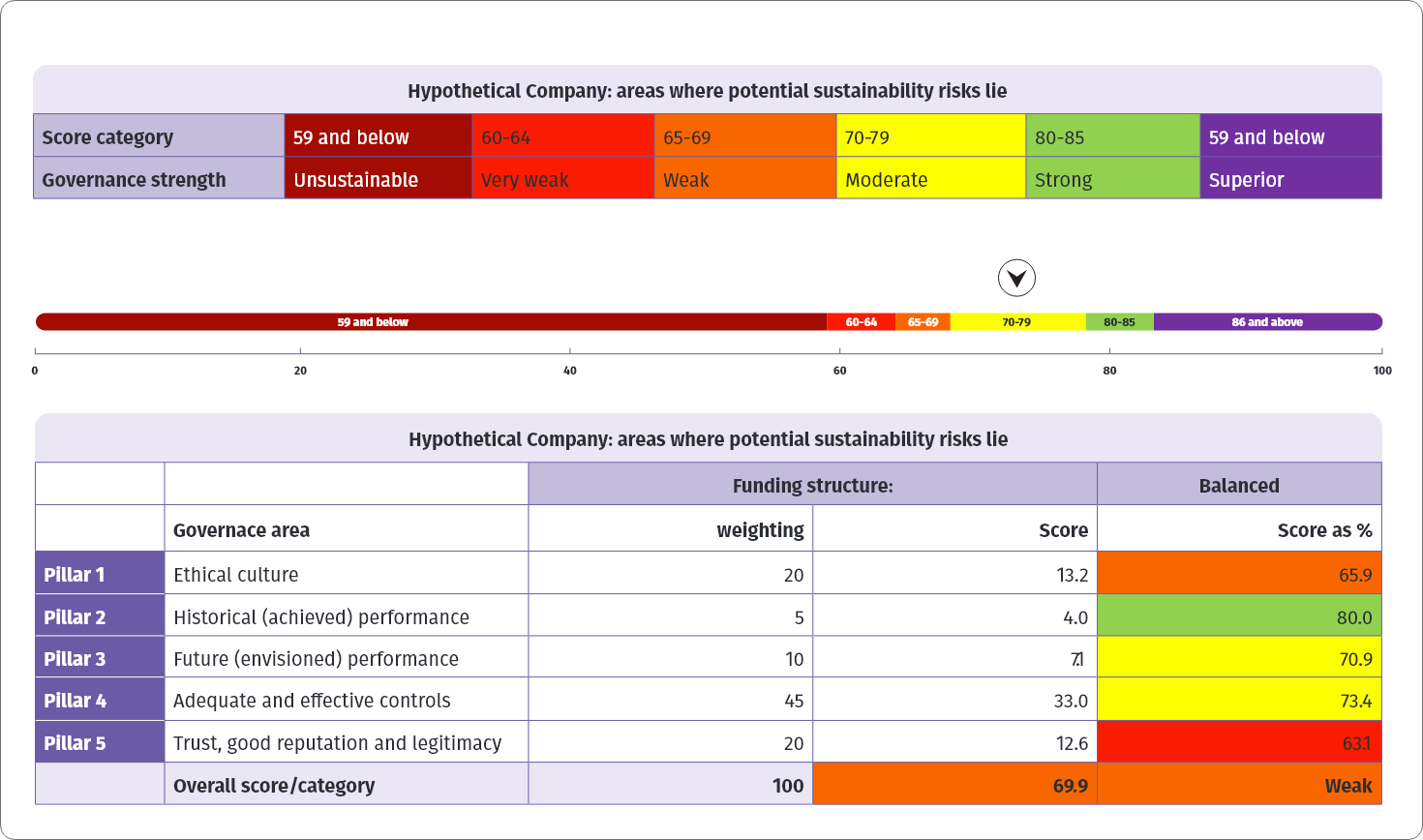

Our research process includes detailed scoring of an entity’s ability to create long-term value in an ethical, sustainable manner. Scoring highlights potential risks and facilitates comparison between companies on various different levels.